Understanding Repossessed Loaders. A Comprehensive Guide

Introduction to Repossessed Loaders

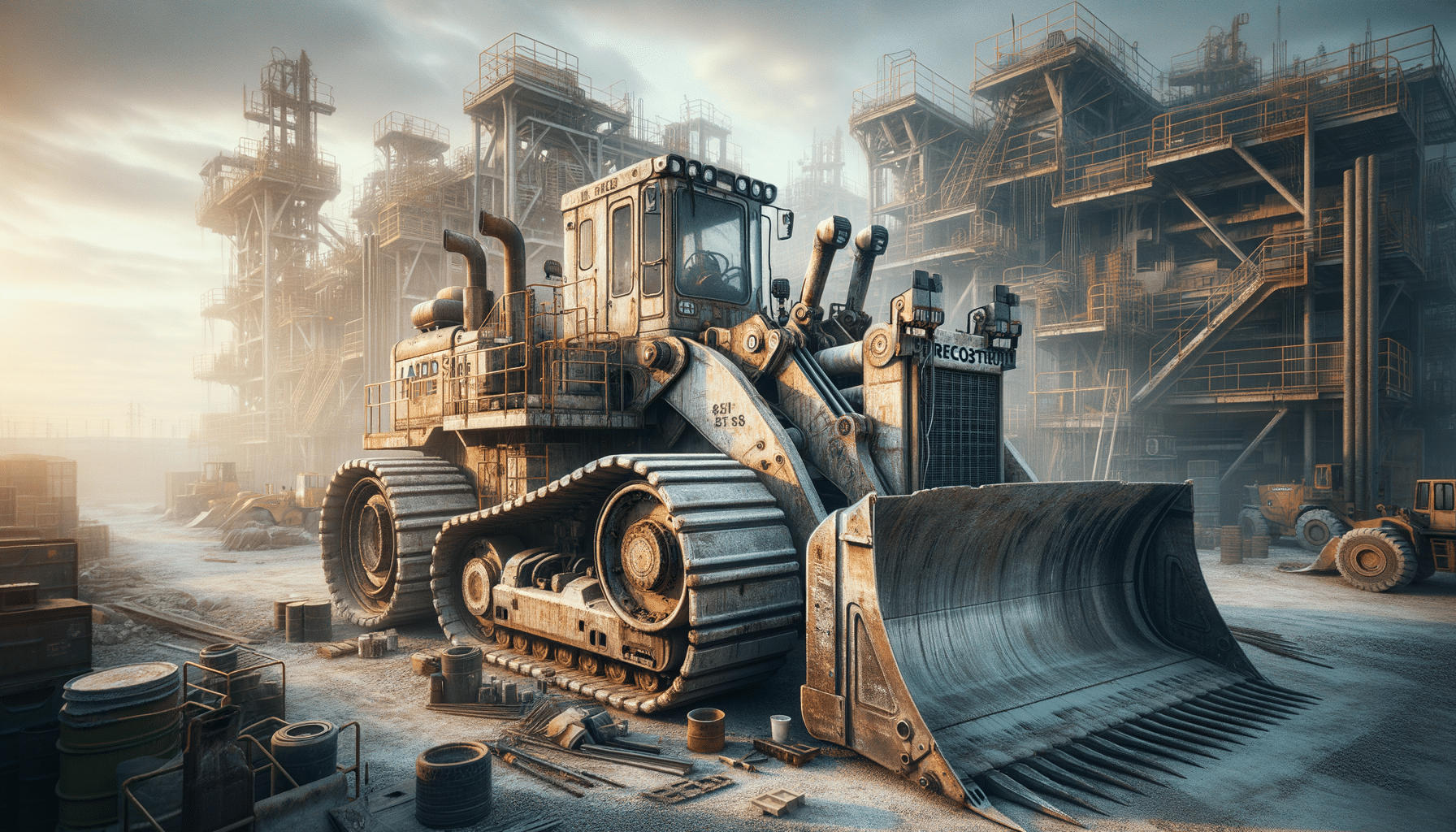

Repossessed loaders offer a unique opportunity for businesses and individuals looking to invest in heavy machinery at reduced costs. These machines, often reclaimed due to financial defaults, present a viable option for those who need reliable equipment without the hefty price tag. Understanding the dynamics of repossessed loaders can help buyers make informed decisions and capitalize on some of the industry’s top-rated deals.

The Benefits of Purchasing Repossessed Loaders

Purchasing a repossessed loader can offer several advantages. Firstly, these loaders are typically sold at a fraction of their original price, making them financially appealing. Buyers can access high-quality machinery that might otherwise be outside their budget. Additionally, since these loaders are often relatively new and well-maintained, they provide excellent value for money. The financial savings extend beyond the purchase price, as buyers may also benefit from reduced insurance costs due to the lower valuation of used equipment.

Another significant benefit is the potential for a quick acquisition process. Unlike new machinery, which often involves long lead times for manufacturing and delivery, repossessed loaders are readily available, allowing buyers to get their operations running swiftly. Furthermore, purchasing repossessed loaders can sometimes include warranties or service plans that add an extra layer of security for the buyer.

Key Considerations When Buying Repossessed Loaders

When considering the purchase of a repossessed loader, it’s crucial to conduct thorough research. Firstly, buyers should verify the machine’s history and condition. This includes checking maintenance records and any previous usage details to ensure the loader has been well cared for. It’s also advisable to have a professional inspection conducted to identify any potential issues that could lead to costly repairs in the future.

Additionally, understanding the terms of sale is vital. Buyers should be aware of the auction or sale process, including any fees or additional costs involved. Knowing the market value of similar loaders can also help in making competitive bids or negotiating effectively. Lastly, it’s important to consider the loader’s compatibility with existing equipment and whether it meets the specific needs of the buyer’s operations.

Where to Find Repossessed Loaders

Repossessed loaders can be found through various channels, each offering different advantages. Auctions, both online and in-person, are popular venues for acquiring these machines. They provide a platform where buyers can find a range of options and potentially purchase at lower prices. Additionally, financial institutions and equipment dealers often have listings for repossessed loaders, providing a more direct and sometimes less competitive purchasing environment.

It’s also beneficial to network within the industry, as word-of-mouth can lead to discovering private sales or upcoming auctions. Online marketplaces and classified ads are also valuable resources for finding repossessed loaders. Regardless of the source, it’s essential to approach each opportunity with due diligence, ensuring that the loader meets all necessary requirements and is priced fairly.

Conclusion: Making the Most of Repossessed Loaders

Repossessed loaders present a cost-effective solution for acquiring heavy machinery without compromising on quality. By understanding the advantages and conducting thorough research, buyers can make informed decisions that benefit their operations. Whether through auctions, dealers, or private sales, the key is to approach each purchase with a clear understanding of needs and market conditions. With careful consideration, repossessed loaders can be a valuable asset, contributing to the efficiency and success of various industrial projects.