Understanding RV Takeover Payments: A Comprehensive Guide

Introduction to RV Takeover Payments

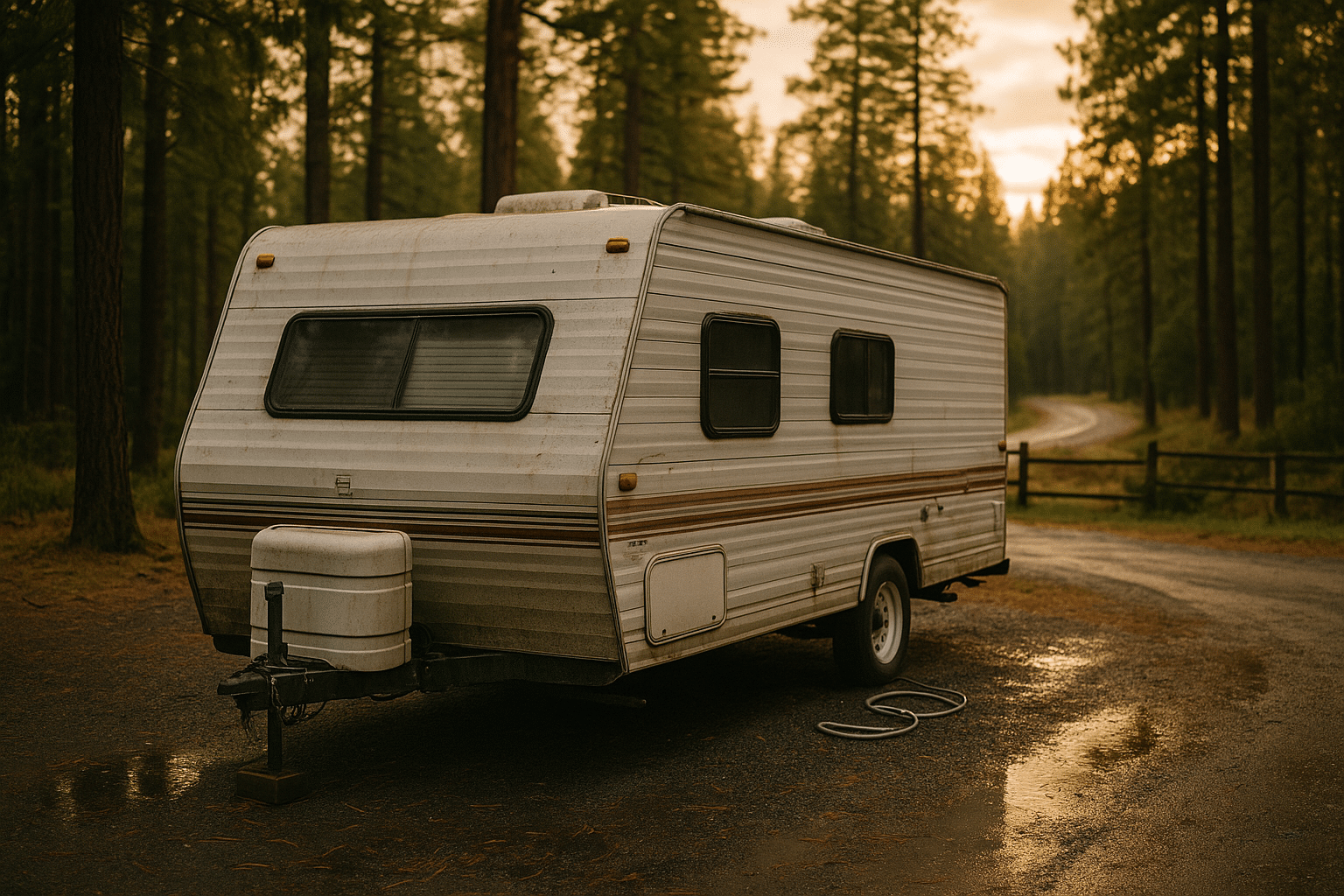

The world of recreational vehicles (RVs) offers a unique blend of adventure and comfort, making it an attractive choice for travel enthusiasts. However, purchasing an RV outright can be a daunting financial commitment. This is where RV takeover payments come into play. Understanding RV takeover payments can provide a viable alternative for those looking to enjoy the RV lifestyle without the initial financial burden. In this guide, we delve into the concept of RV takeover payments, exploring their benefits, potential drawbacks, and essential considerations.

What Are RV Takeover Payments?

RV takeover payments refer to a financial arrangement where an individual assumes the remaining payments on an existing RV loan. This process is similar to taking over a lease for a vehicle but involves the transfer of loan obligations. The original owner may seek to transfer payments for various reasons, such as financial constraints or lifestyle changes. For the new owner, this can mean acquiring an RV without the need for a substantial down payment or a new loan.

The process typically involves:

- Reviewing the existing loan terms and conditions.

- Negotiating with the current owner to agree on the takeover terms.

- Obtaining approval from the lender for the payment transfer.

- Ensuring all paperwork is correctly handled to facilitate a smooth transition.

This option can be particularly appealing for those who want to test the waters of RV ownership without making a long-term commitment.

Advantages of RV Takeover Payments

Opting for RV takeover payments presents several advantages for potential RV owners. One of the most significant benefits is the reduction in upfront costs. Since the RV has already been financed, the new owner only needs to continue with the remaining payments, avoiding the initial large down payment typically required for a new purchase.

Additionally, RV takeover payments can offer:

- Flexibility: With the possibility of shorter loan terms, new owners can enjoy a trial period before fully committing to RV ownership.

- Potential Cost Savings: Depending on the terms of the original loan, new owners may benefit from lower interest rates or monthly payments.

- Immediate Use: Unlike waiting for a new RV to be manufactured or delivered, the RV is available for immediate use once the takeover is complete.

These factors make RV takeover payments an attractive option for those eager to embark on their RV journey with fewer financial constraints.

Challenges and Considerations

While RV takeover payments offer numerous benefits, they are not without challenges. Prospective owners should carefully evaluate the condition of the RV and the terms of the existing loan. It is crucial to conduct a thorough inspection to ensure there are no hidden issues that could lead to costly repairs. Additionally, understanding the remaining loan balance and any associated fees is essential to avoid unexpected expenses.

Considerations for RV takeover payments include:

- Loan Terms: Reviewing the interest rate, monthly payments, and remaining loan duration.

- RV Condition: Inspecting the RV for wear and tear, maintenance history, and potential upgrades needed.

- Lender Approval: Ensuring the lender approves the transfer to avoid legal complications.

By addressing these considerations, potential owners can make informed decisions that align with their financial goals and lifestyle preferences.

Conclusion: Is RV Takeover Right for You?

RV takeover payments can be a practical solution for those seeking to experience the RV lifestyle without the initial financial burden of purchasing a new vehicle. This option provides flexibility, potential cost savings, and immediate access to an RV, making it an attractive choice for many. However, it is essential to weigh the benefits against the challenges and conduct thorough research to ensure a successful transition.

Ultimately, the decision to pursue RV takeover payments should be based on individual circumstances, financial capabilities, and long-term travel goals. By understanding the intricacies of this option, prospective RV owners can embark on their adventures with confidence and peace of mind.