Understanding RV Takeover Payments

Introduction to RV Takeover Payments

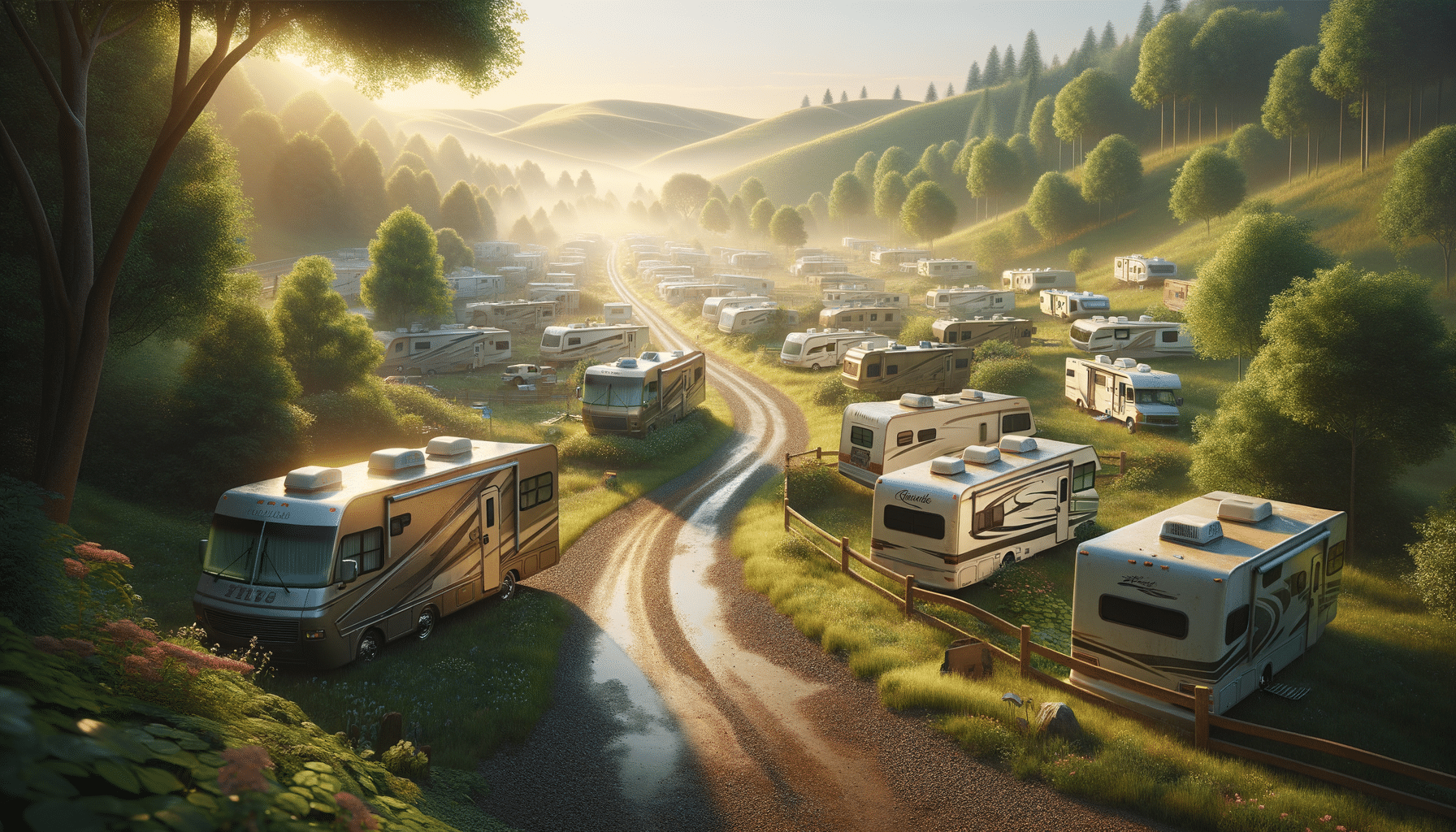

In the expansive world of recreational vehicles (RVs), the concept of RV takeover payments is gaining traction as a flexible financial option for both buyers and sellers. This arrangement allows individuals to transfer the remaining payments of an RV loan to another party, often providing a viable solution for those looking to either enter or exit the RV lifestyle without the complications of traditional buying or selling methods. Understanding the dynamics of RV takeover payments can open up new opportunities, particularly in a market that values flexibility and cost-effectiveness.

The Mechanics of RV Takeover Payments

RV takeover payments involve a legal and financial process where an individual takes over the remaining payments of an RV loan from the current owner. This typically requires the approval of the lender, as the new party must meet the necessary credit and income requirements. The process can be advantageous for the current owner who might be looking to offload the RV due to lifestyle changes or financial constraints, and for the new owner who might find this a less expensive entry into RV ownership.

Key steps in the process include:

- Contacting the lender to discuss the possibility of a loan transfer.

- Assessing the RV’s current value compared to the remaining loan amount.

- Ensuring both parties agree on terms and conditions, including any additional payments or fees.

Successfully navigating these steps can lead to a mutually beneficial arrangement, allowing for a seamless transition of ownership.

Advantages and Considerations for Buyers

For potential buyers, RV takeover payments present a unique opportunity to enter the RV market without a hefty upfront cost. One significant advantage is the potential to acquire an RV at a lower overall cost, assuming the original loan terms are favorable. Additionally, buyers can avoid the depreciation hit that often accompanies new RV purchases, as they are taking over payments on a pre-owned vehicle.

However, buyers must consider a few key factors:

- Thoroughly inspecting the RV to ensure it is in good condition.

- Understanding the original loan terms, including interest rates and duration.

- Being prepared for any maintenance or repair costs that may arise.

With careful consideration and due diligence, buyers can leverage RV takeover payments to their advantage, securing a quality vehicle at a reduced financial burden.

Benefits for Sellers Considering RV Takeover

Sellers facing changes in their lifestyle or financial situation may find RV takeover payments an appealing option. This process allows sellers to transfer their financial obligation to another party, potentially avoiding the hassle and time associated with selling an RV outright. It can also prevent negative impacts on credit scores that might result from defaulting on a loan.

For sellers, the primary benefits include:

- Quickly relieving themselves of financial obligations.

- Potentially maintaining a good credit standing by avoiding loan defaults.

- Facilitating a smoother transition if downsizing or upgrading to a different vehicle.

By understanding and leveraging this option, sellers can achieve a more favorable financial and logistical outcome.

Conclusion: Navigating the RV Takeover Process

RV takeover payments offer a compelling alternative for both buyers and sellers in the recreational vehicle market. For buyers, it presents an opportunity to step into RV ownership with potentially lower costs and more manageable financial commitments. For sellers, it provides a path to transfer their loan obligations seamlessly, often with fewer complications than a traditional sale. As with any financial transaction, careful consideration, and thorough research are essential to ensure a beneficial outcome for all parties involved.

Ultimately, understanding the nuances of RV takeover payments can empower individuals to make informed decisions, aligning their financial and lifestyle goals with the realities of RV ownership.